Easily calculate and collect sales tax on your checkouts

Taxes by Spiffy enables some advanced sales tax controls and reporting regardless of what country your business is based in.

Table of Contents

- Enabling Taxes by Spiffy

- Collecting US Sales Tax

- Collecting CAN HST/GST

- Collecting UK/EU VAT

- Collecting AU GST

- Setting Products and Line Items as Taxable

Enabling Taxes by Spiffy

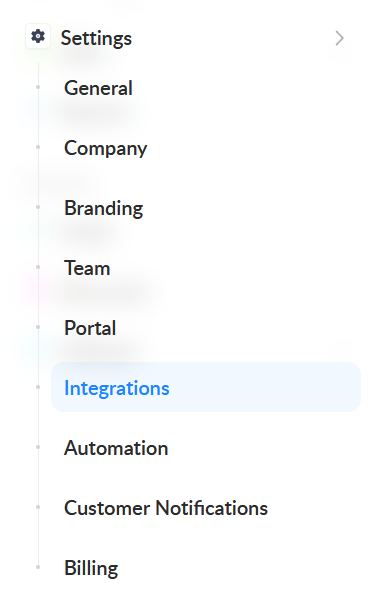

Click on Settings > Integrations in the bottom left navigation.

Select Taxes by Spiffy from the available integrations

Select your Business Country and click Enable Taxes to open the configuration options. Below, we will cover the configuration options.

Collecting US Sales Tax

After you have selected your Business Country and clicked Enable Taxes, you will see the expanded configuration options.

Configure the following:

- Domestic Taxes Toggle – Turn on if you ONLY need to calculate taxes for US customers

- Nexus States – Select the states that you have economic nexus in and should charge tax

- Default Tax Calculation – Toggle this optional setting on to set a country/zipcode as a default tax calculation on checkouts. This will recalculate when a customer enters their billing address

Once configured, click ‘Save Settings’. Once connected, you will then need to enable taxes on any checkout items and subscription products.

Collecting CAN HST/GST

After you have selected your business country as Canada, we will automatically calculate HST / GST. You’ll have the option to exclude certain Providences from PST calculation.

Collecting UK/EU VAT

After you have selected your business country (UK or EU), you will see the expanded configuration options

Configure the following:

- Domestic Taxes Toggle – Turn on if you ONLY need to calculate taxes for domestic customers

- Enable VAT MOSS – If your business is enrolled in VAT Mini One Stop Show, enable the toggle

- Default Tax Calculation – Toggle this optional setting on to set a country/postal code as a default tax calculation on checkouts. This will recalculate when a customer enters their billing address

Collecting AU GST

After you have selected your business country (AU), you will see the expanded configuration options

Configure the following:

- Domestic Taxes Toggle – Turn on if you ONLY need to calculate taxes for domestic customers

- Default Tax Calculation – Toggle this optional setting on to set a country/postal code as a default tax calculation on checkouts. This will recalculate when a customer enters their billing address

Setting Products and Line Items as Taxable

After you enable Taxes by Spiffy, you’ll also need to make sure your Products, Subscriptions, and standard Line Items are set as taxable.

Follow the steps below to make Products and Subscriptions taxable:

- From your Products list, select the Product or Subscription to edit

- On the dashboard, select Settings

- Turn on the toggle Enable Product Tax

- Click Save

Your Product or Subscription will now be taxable across all checkouts.

Not using Products or Subscriptions?

You’ll need to make standard, single pay Line Items taxable from within your individual checkouts. Learn how to set Line Items as taxable

NOTE: To ensure you are charging tax, make sure you are collecting a billing address on all checkouts.