TaxJar is a third-party tax calculation and reporting app that you can integrate with Spiffy Checkouts. It has more advanced tax reporting and filing capabilities that are well-suited for companies based in the United States. If you’re a company outside the United States, Taxes by Spiffy will be the best solution for you.

In this article, we will cover how you connect your TaxJar account to Spiffy, as well as a quick look at how you set Checkout Items and Subscription Products to be taxable.

Connecting TaxJar

You will need an active TaxJar, and your TaxJar Secure API Key on hand.

If you are logged into your TaxJar account, just head to https://app.taxjar.com/account#api-acces

If you haven’t used TaxJar’s API before, there will be an option to generate a secure API Key.

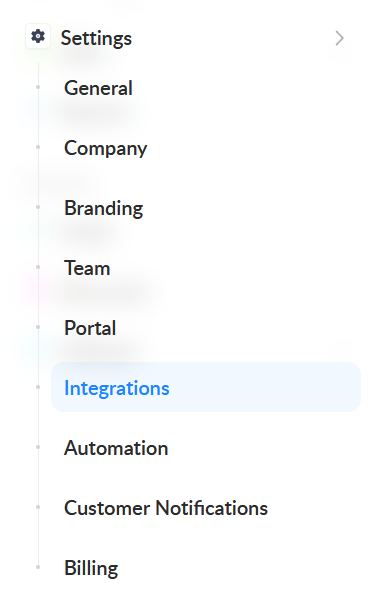

Once you have your TaxJar secure API key, we will head over to Spiffy. Just click on Settings > Integrations from the bottom left navigation.

Find and select TaxJar from the available integrations

Enter your TaxJar Secure API Key, and click Connect TaxJar

Once connected, you will then need to enable taxes on any checkout items and subscription products.

Be sure to review the video and information below, especially if you are enabling taxes on ‘Subscription’ products, as you will need to enable taxes for subscriptions from your account’s ‘Subscription’ tab, and ‘Standard’ item tax will need to be enabled from within your individual checkouts

Enabling Taxes on Checkout Items and Subscriptions

Any checkout that you are collecting taxes on will require the ‘Billing Address’ to be collected, as this is how we calculate taxes

In this quick video, we will show you how to enable taxes on checkout items from within the checkout editor, as well as how to enable taxes on Subscriptions from your ‘Subscriptions’ tab in Spiffy!